The following are excerpts, edited by Marjorie Beggs, from Jericha Senyak’s presentation at Fiscal Sponsor Conversations, October 24, 2023. Fifty-five sponsors from around the country attended the online forum.

Andrew Schulman: Our guest presenter today, Jericha Senyak, provides financial consulting, coaching and empowerment to artists and arts organizations in the Bay Area and beyond. Her clients include theater and dance companies, orchestras, choirs, visual and performing artists, social practice artists and the fiscal sponsors of those artists. Her work includes full-spectrum accounting support, financial reporting support along with individual and group coaching. If you’ve never met her before, you’re in for a real treat.

Jericha: Thank you, Andrew. I’m really grateful to everybody who showed up for a conversation about accounting, which I know isn’t everybody’s favorite topic and carries a lot of stress, a lot of pain and, for many folks, a lot of trauma.

I’m a big evangelist for fiscal sponsorship — I really believe in its power. For today’s conversation, I’ll touch on some practical concerns that I think create valuable context, no matter what size the fiscal sponsor is. I specialize in financial empowerment, a term I prefer to financial literacy, primarily because anybody working in the nonprofit sector for any amount of time is financially literate just by virtue of keeping the doors of your organization open.

So what is good accounting for a fiscal sponsor and why do I think it matters? I’m an accountant. When you’re a hammer, everything looks like a nail. To me, fiscal sponsorship is 70% accounting. What are some helpful ways to approach accounting systems and solutions?

A good accounting system allows you to have certain things you don’t otherwise have: clarity, this is the big one, about whose money is whose. I’ve worked with fiscal sponsors basically doing napkin math on this who’ve ended up paying out money that isn’t theirs, that’s someone else’s, that actually belongs to them, the host organization.

“Good accounting gives you easy answers.”

Besides knowing whose money is whose, good accounting gives you easy answers to projects’ questions: What’s my balance? Do I have anything remaining on this grant? When did I do the activity? What did I spend my money on? When can I expect my money? And good accounting also results in simplified grant reporting and invoicing, and helps you catch and resolve errors quickly. What are the processes for finding out you’ve made a mistake? What processes do you have in place for resolving that mistake? A good accounting system is one that has lots of fail-safes, lots of error checks.

Many fiscal sponsors realize it’s difficult to do traditional budgeting because you have projects coming in and going out. You need an accounting system that helps you to understand your own context, make decisions, pivot when needed, forecast, and otherwise understand your own financial flow and operations. Finally, the last thing, and not the least in any way, is that a good accounting system aids increased advocacy — it gives you a structure and a set of tools, budgets and workflows so you can confidently advocate and fundraise.

Supporting the stories you tell

As a fiscal sponsor, you need numbers that support the stories you’re telling and the information that you’re moving in and out of your organization. It also gives your projects a clear understanding of their available balances. That may seem obvious, but many of my clients find it hard to tell a project on any given day how much money they have available.

Projects and their budgets can grow, and a fiscal sponsor, especially a small one or one without strong reporting or tracking tools, may find it hard to manage larger, more complex grants. Reimbursement grants from cities, for example, are a common pain point. To access the promised funds, you need a line-by-line accounting of everything spent tracked against each individual grant. If a project gets a large city grant for the first time and your accounting system can’t support it, your project will have a hard time accessing those funds. The more fluid and efficient your accounting system is, the easier it will be for those projects to get, spend and manage bigger chunks of money.

Also, the better your accounting, the clearer your project is about your role and your ability to provide information. The project can say, “Okay, I know exactly what reports I’m getting. I know when and what kind of for information I can ask for.” That results in less stress at tax time for projects because they’re confident in your ability to provide them with accurate information. Also, the better your system of managing funds, the easier it is for you to communicate with your projects, build trust with them, and prove that they can trust you to support them, that you have their best interests at heart and that you will advocate for them.

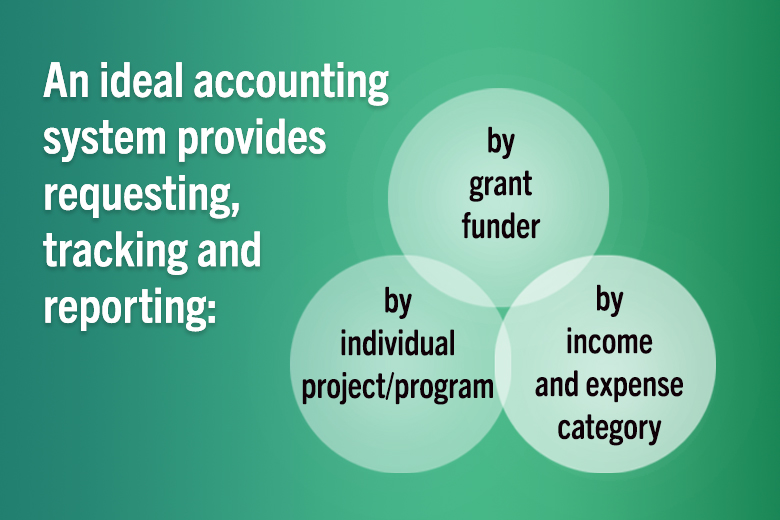

So there are three things that any accounting system should provide to you easily, fluidly and without misery, regardless of your size: You should be able to request, track and report financial information 1) by individual project, 2) by grant or funder, and 3) by income and expense category.

Systems that meet your needs

Your system probably has a pain point around one of these three, maybe around all of them. Part of that is simply because no existing accounting software is specialized for the needs of fiscal sponsors. You can make QuickBooks do these three things if you set it up exactly right, but it’s a heavy lift, and basically you have to break existing financial systems to make them work for you.

Other systems, like Mazlo and Sage Intacct, provide some solutions, but almost all have to be tailor-made for your needs. That means doing your research to figure out what options are out there, what works or doesn’t work for others, and spending time investing and reinvesting in maintaining that system. It’s never going to be a plug-and-play situation. Accounting systems have to be tended like the delicate, gigantic plants they are.

I want to take a second to acknowledge that if you’re a fiscal sponsor, you’re facing the most complex accounting challenge in any kind of business and doing it without appropriate tools. If you feel miserable, that’s a good indicator that the system is failing you, not that you’re failing or doing something wrong or just don’t get it. It’s almost always indicates that the system’s not working for you.

Accounting is a form of knowledge — of the transactions going in and out of your organization — and knowledge is power. Part of empowerment is about feeling good. A good system feels good to use — that’s how you know it’s working for you. This is my mantra as an accountant.

Contact Jericha Senyak

Marjorie Beggs is San Francisco Study Center senior writer and editor, and manager of the Fiscal Sponsor Directory

Source, graphic top: Jericha Senyak